Shares of The Walt Disney Company (NYSE: DIS) fell over 4% on Monday, despite the company beating expectations on its first quarter 2026 earnings results. The entertainment giant recorded revenue growth across its segments but profits were pressured by high costs. The streaming division continued its momentum, with AI set to play a key role in the picture going forward.

Revenue and earnings beat estimates

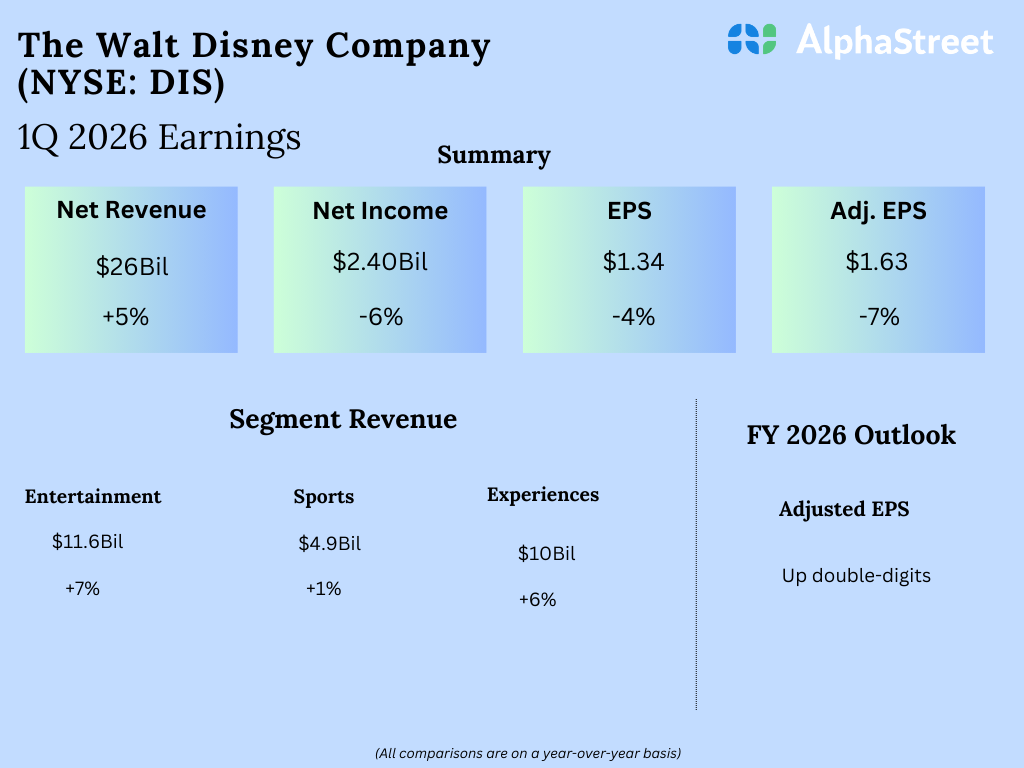

In the first quarter of 2026, Disney’s revenues increased 5% year-over-year to $25.98 billion, beating estimates of $25.56 billion. On a GAAP basis, earnings per share fell 4% to $1.34. Adjusted EPS declined 7% to $1.63 but surpassed projections of $1.57.

Entertainment – streaming a strong spot, AI content

In Q1, Disney’s Entertainment segment saw revenues grow 7%, helped by higher subscription fees and subscriber growth, and an increase in content sales revenue. Operating income decreased 35% due to higher programming, production and marketing costs.

During the quarter, movies like Zootopia 2 and Avatar: Fire and Ash performed well in theatres while also fueling viewership of related titles on the Disney+ streaming service, and interest in theme park attractions.

Total Entertainment SVOD, or streaming services, revenues increased 11% in Q1 to $5.3 billion while operating income jumped 72% to $450 million. SVOD operating margin was 8.4%. Disney continues to work on upgrading the user experience by improving recommendations and increasing personalization. The company has partnered with OpenAI to create short videos featuring Disney characters on the latter’s short-form generative AI video platform, Sora. It plans to roll out a “curated slate of Sora-generated content on Disney+” to drive engagement.

Disney expects its investments in content and technology will help drive revenue growth and the company said it remains on track to reach a 10% SVOD operating margin in fiscal year 2026.

Revenue growth in Sports and Theme Parks

Revenue in the Sports segment inched up 1% to $4.9 billion while operating income fell 23% to $191 million, as a 10% growth in advertising revenue was offset by higher programming and production costs, a drop in subscription fees, and the temporary suspension of YouTube TV carriage.

In the Experiences segment, revenue increased 6% YoY to exceed $10 billion for the first time and operating income rose 6% to $3.3 billion, driven by higher volumes attributable to increased passenger cruise days, attendance and occupied room nights, as well as an increase in guest spending. Disney has expansion projects underway across all its theme parks with new features and attractions.

Outlook

For fiscal year 2026, Disney expects double-digit operating income growth in the Entertainment segment, low-single-digit operating income growth in the Sports segment, and high single-digit operating income growth in the Experiences segment. The company expects adjusted EPS to grow double-digits in FY2026.