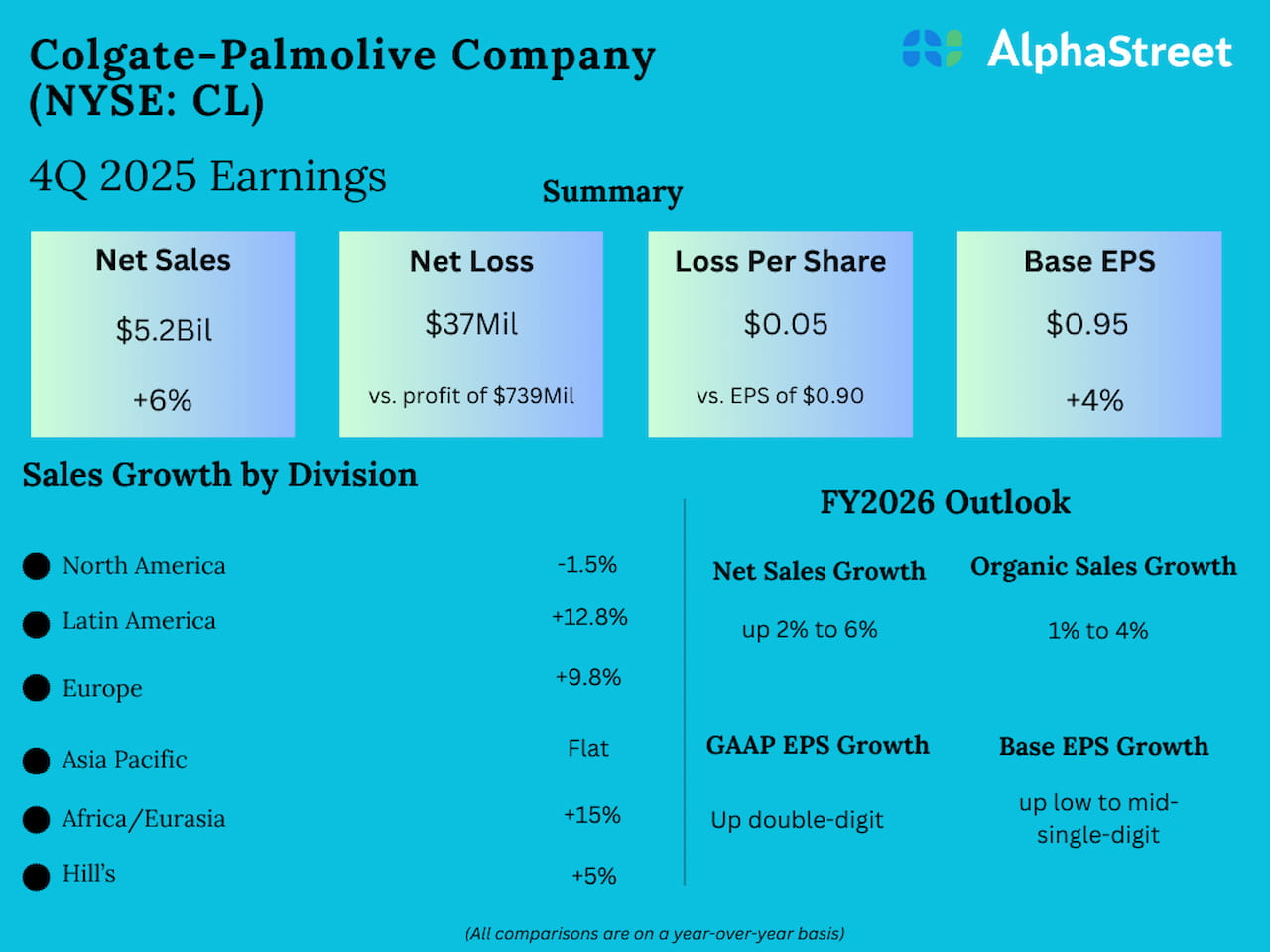

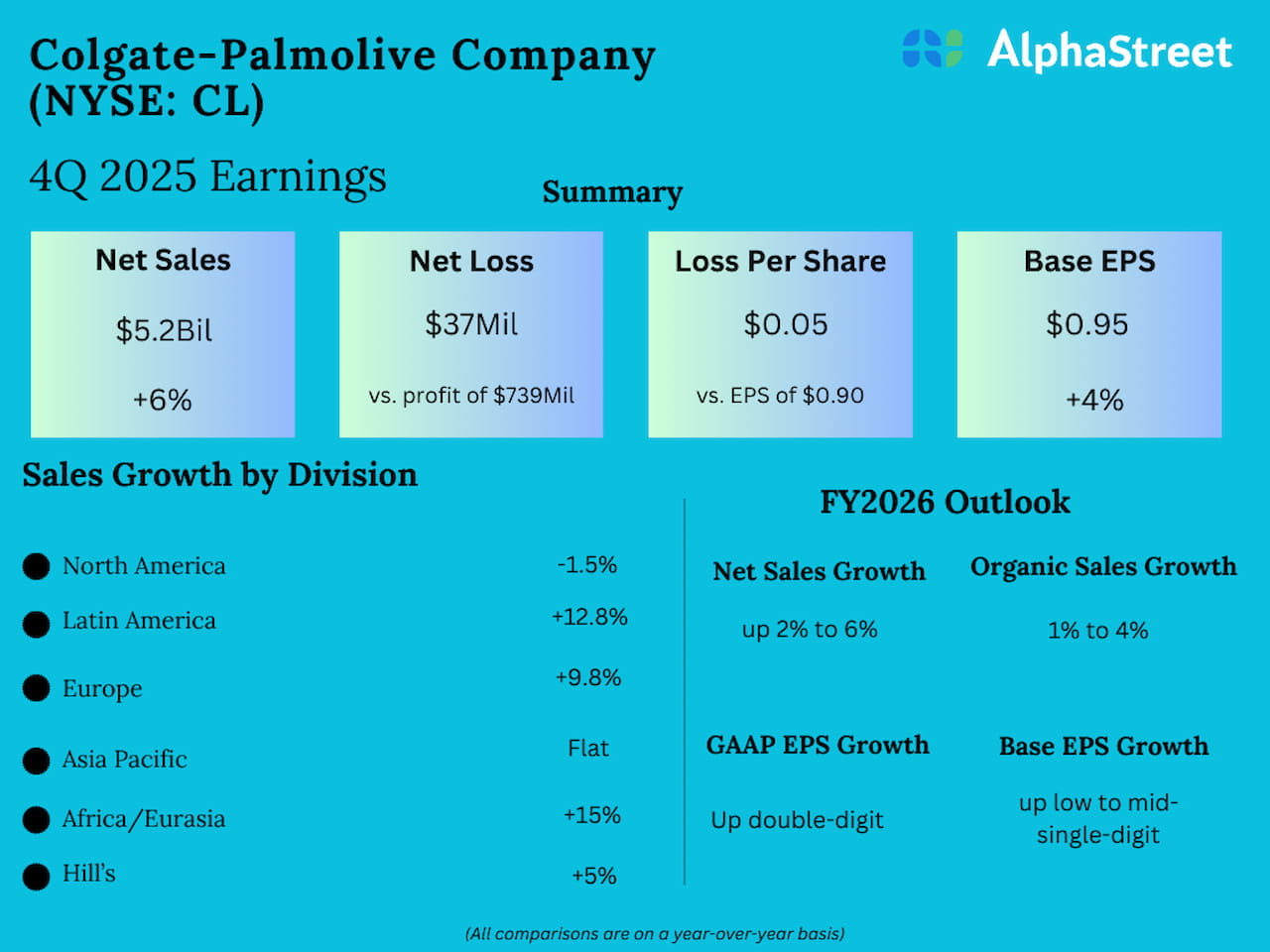

Colgate-Palmolive Company (NYSE: CL) on Friday reported higher sales and earnings for the fourth quarter of fiscal 2025. The numbers also exceeded estimates, sending the stock higher in the premarket.

Earnings Beat

The consumer products company posted base earnings, adjusted for one-off items, of $0.95 per share for the December quarter, higher than $0.91 per share reported in the year-ago quarter. Analysts were expecting flat earnings.

Driving the earnings growth, net sales increased to $5.23 billion in Q4 from $4.94 billion in the same period of 2024, beating Wall Street’s estimates. Organic sales moved up 2.2% YoY. On an unadjusted basis, the company reported a net loss of $37 million or $0.05 per share for the fourth quarter, compared to a profit of $739 million or $0.90 per share in the year-ago quarter.

Guidance

For fiscal 2026, the company expects net sales to be up 2% to 6%, including a low-single-digit positive impact from foreign exchange. The guidance for full-year organic sales growth is 1-4%. On a reported basis, gross profit margin is expected to expand in FY26, with advertising up and double-digit earnings per share growth.

Noel Wallace, the company’s CEO, said, “As we begin 2026, while we expect the difficult operating environment and slower category growth to continue in the short term, we are operating from a position of strength and are confident that the changes we are making will enable us to deliver consistent, compounded earnings per share growth and drive shareholder value in the long term.”